The healthcare industry is undergoing rapid transformation, with Artificial Intelligence (AI) emerging as a key driver of change in revenue cycle management (RCM). AI-powered solutions have brought about a revolution in claim management, helping healthcare providers tackle long-standing inefficiencies and optimize their operational workflows. By automating routine tasks, enhancing accuracy, and providing predictive insights, AI is reshaping how claims are processed, reducing errors, and accelerating reimbursements. In this blog, we’ll delve into how AI is enhancing claim management within healthcare revenue cycles, improving both operational efficiency and financial performance. We’ll also discuss the compelling reasons why your organization should embrace this cutting-edge technology to stay competitive, ensure compliance, and provide a better experience for both providers and patients.

1. Streamlining Claims Submission

AI tools play a crucial role in optimizing the claims submission process. By automating the preparation and submission of claims, these tools ensure that the data is both accurate and complete, reducing the chance of costly mistakes. Natural Language Processing (NLP) is particularly powerful, as it extracts key information from medical records and matches it against payer requirements. This intelligent automation helps eliminate errors and minimizes the likelihood of claim rejections, leading to smoother, more efficient claim submissions. With fewer issues at this stage, healthcare providers can expect quicker reimbursement cycles and improved financial outcomes.

2. Enhancing Claims Accuracy

Errors in claims, such as coding mistakes or incomplete information, are a leading cause of claim denials. AI-powered software tackles this issue by automatically detecting and correcting errors before claims are submitted. By cross-referencing claims data with the most up-to-date payer policies and regulatory requirements, AI ensures that claims are accurate and compliant. This proactive approach not only reduces the risk of denials but also minimizes the need for rework and resubmissions. The result is a significant boost in approval rates and a more efficient revenue cycle. Additionally, by identifying potential issues early, AI helps healthcare organizations improve the accuracy of their data, reduce administrative costs, and enhance overall claim processing efficiency. This leads to quicker reimbursements, reduced financial strain, and a smoother billing experience for both providers and patients.

3. Accelerating Claims Processing

raditional claims processing is often slow and inefficient, leading to delays in reimbursements for healthcare providers. AI transforms this process by automating time-consuming manual tasks like data entry, verification, and validation. By reducing human intervention, AI speeds up claims processing, allowing claims to be submitted and reviewed more quickly. This leads to faster reimbursements, improving cash flow and financial stability for healthcare organizations. Furthermore, AI enhances the accuracy of claims, minimizing errors and reducing the need for resubmissions or follow-ups. By streamlining the entire claims process, AI enables healthcare providers to focus more on patient care and less on administrative tasks, ultimately boosting operational efficiency and profitability

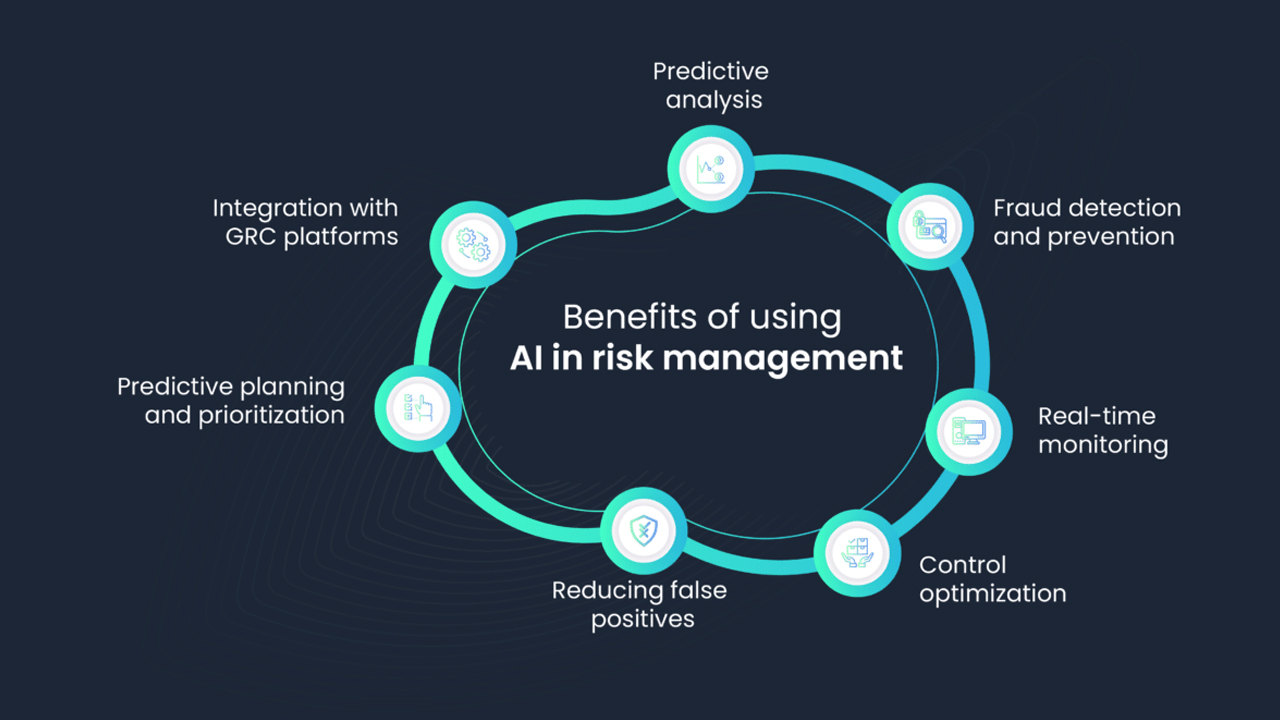

4. Predicting Denials and Reducing Rejections

AI algorithms analyze historical claims data to uncover patterns that often lead to denials. By leveraging predictive insights, these tools enable healthcare providers to proactively address potential issues before claims are even submitted. This foresight allows providers to make necessary adjustments to claims, increasing the chances of approval and reducing the likelihood of rejections. AI-driven systems also highlight common errors, ensuring that claims are submitted correctly the first time. By optimizing this process, healthcare organizations can minimize delays, avoid costly rework, and enhance revenue cycle efficiency, ultimately leading to improved financial outcomes and smoother patient interactions.

5. Improving Revenue Cycle Efficiency

AI-powered claims management tools seamlessly integrate with existing RCM systems, creating a cohesive and streamlined workflow that optimizes the entire revenue cycle. By automating repetitive tasks such as data entry, claim submission, and follow-ups, these tools reduce administrative burden, leading to faster claim processing and fewer errors. Additionally, AI provides real-time insights, identifying trends and potential issues before they escalate. This empowers staff to focus on more strategic tasks, such as enhancing patient care, improving financial planning, and driving overall organizational growth, resulting in better efficiency and cost savings.

6. Enhancing Compliance and Reducing Risks

With ever-changing regulations and payer requirements, maintaining compliance in claims management can be a challenge. AI helps by automatically updating rules and guidelines to ensure claims align with the latest standards. This proactive approach reduces the risk of penalties and audits, protecting your organization’s reputation and financial stability. By staying compliant effortlessly, AI minimizes costly errors and ensures smoother claims processing.

7. Boosting Patient Satisfaction

Efficient claims management not only benefits healthcare providers but also significantly improves the patient experience. Faster claims processing and fewer errors lead to quicker resolutions, minimizing financial stress for patients. AI-powered tools enhance communication between providers and payers, ensuring a more seamless billing process. Improved accuracy and transparency lead to fewer billing discrepancies, boosting patient satisfaction and trust in the healthcare system. AI streamlines the entire workflow, reducing administrative burdens and allowing healthcare professionals to focus more on patient care.

Conclusion

AI is transforming claims management within healthcare revenue cycles by improving accuracy, efficiency, and compliance. AI-powered tools automate complex tasks, reduce errors, speed up reimbursements, and improve overall revenue cycle performance. For healthcare organizations looking to stay competitive, adopting AI in claims management is no longer optional – it’s essential.

Are you ready to take your claims management to the next level? At Aiclaim, we provide state-of-the-art AI-driven solutions tailored to optimize your healthcare revenue cycle. Contact us today to learn more!