Healthcare providers today face increasing financial pressure. Rising denial rates, changing payer rules, and complex documentation requirements make reimbursement more difficult than ever. Because of this, one performance metric has become mission-critical for Revenue Cycle Management (RCM) leaders — first pass claim acceptance rate.

The good news? Artificial Intelligence (AI) is now transforming how healthcare organizations improve first pass claim acceptance, reduce denials, and accelerate payments.

In this guide, we’ll break down what first-pass acceptance really means, current industry benchmarks, why claims fail, and how AI-powered platforms like Aiclaim help providers consistently submit cleaner claims the first time.

What Is First Pass Claim Acceptance Rate?

First pass claim acceptance rate (FPAR) measures the percentage of claims that are accepted by payers on the first submission without rework. In simple terms, it tells you how many claims go through successfully the first time — without edits, rejections, or denials.

Formula:

First Pass Acceptance Rate = (Claims accepted on first submission ÷ Total claims submitted) × 100

This KPI directly impacts:

- 💰 Cash flow speed

- 🧾 Billing team workload

- 🔁 Rework and resubmission costs

- 📉 Denial rates

- 🏥 Overall financial stability

Therefore, when providers improve first pass claim acceptance, they not only reduce administrative burden but also accelerate revenue.

Why First Pass Acceptance Matters More Than Ever

Today’s healthcare reimbursement environment is unforgiving. Even small mistakes can trigger rejections.

However, improving first pass claim acceptance leads to:

✔ Faster reimbursements

✔ Lower denial management costs

✔ Reduced AR days

✔ Less manual intervention

✔ Higher net collection rates

In contrast, poor first-pass performance creates a ripple effect of delays, appeals, and lost revenue. Consequently, RCM leaders now treat first-pass rate as a top financial health indicator.

Industry Benchmarks for First Pass Claim Acceptance

Understanding benchmarks helps providers evaluate their performance.

| Performance Level | First Pass Acceptance Rate |

|---|---|

| High Performing Organizations | 95% – 98% |

| Industry Average | 85% – 90% |

| Underperforming Providers | Below 85% |

If your organization is below 90%, there is significant room to improve first pass claim acceptance — and AI is often the missing piece.

Common Reasons Claims Fail on First Submission

Before we explore AI solutions, it’s important to understand why claims get rejected.

1. Coding Errors

Incorrect CPT, ICD-10, or modifier usage often leads to instant rejection.

2. Missing or Incomplete Documentation

Payers require precise documentation to justify procedures and diagnoses.

3. Eligibility Issues

Coverage terminated, incorrect insurance ID, or coordination of benefits problems frequently cause failures.

4. Authorization Gaps

Pre-authorization requirements are often overlooked.

5. Demographic Errors

Even minor typos in patient details can trigger rejections.

6. Payer Rule Variations

Each payer has unique formatting and medical necessity rules.

Because of these complexities, manual review alone is no longer enough. As a result, providers are turning to AI-driven claim intelligence.

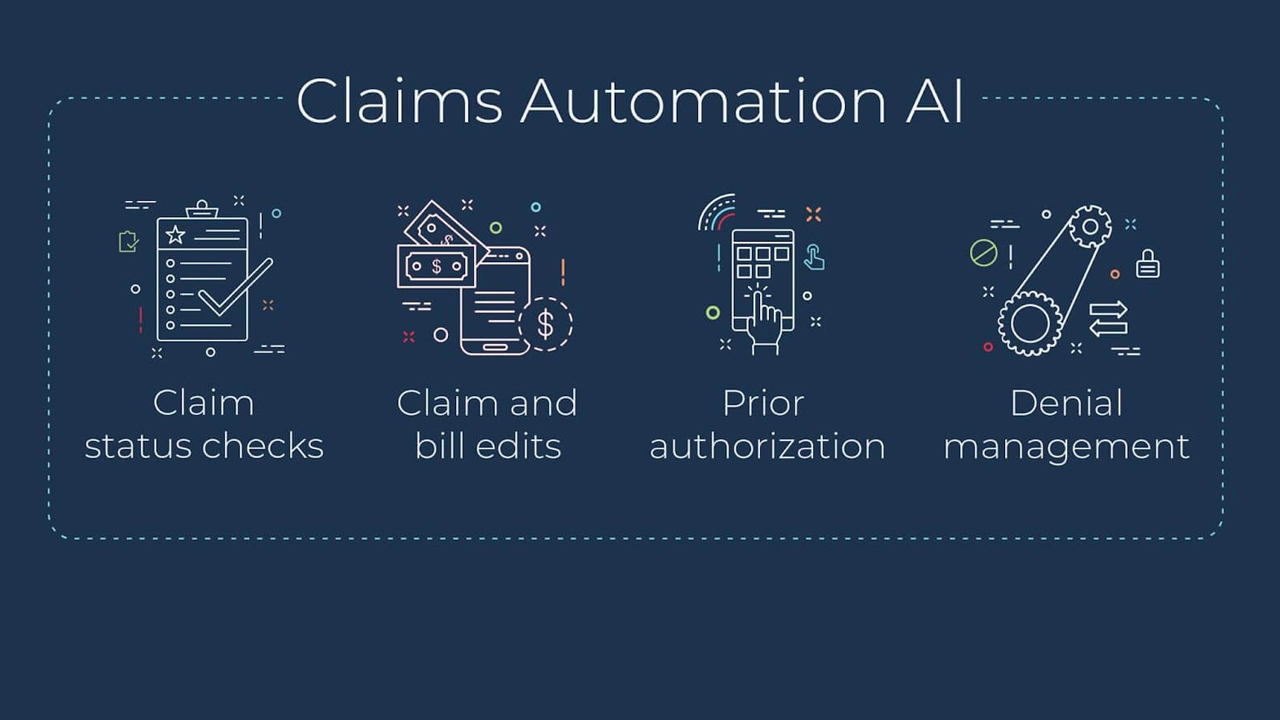

How AI Helps Improve First Pass Claim Acceptance

Artificial Intelligence adds predictive accuracy and automation to the claim review process. Instead of reacting to denials, AI prevents them before submission.

Here’s how.

1. AI-Powered Error Detection Before Submission

AI systems analyze claims line by line, checking:

- Coding accuracy

- Modifier combinations

- Medical necessity compliance

- Documentation alignment

Unlike manual audits, AI reviews 100% of claims, not just samples. Therefore, providers significantly improve first pass claim acceptance by catching errors early.

With Aiclaim, predictive algorithms flag high-risk claims in real time, allowing billing teams to correct issues instantly.

2. Smart Coding Validation

AI cross-references diagnosis codes with procedures, ensuring logical and compliant coding patterns.

For example:

- Detects mismatched diagnosis-procedure pairs

- Flags outdated or invalid codes

- Suggests compliant alternatives

As a result, coding-related denials drop dramatically, which directly helps improve first pass claim acceptance.

3. Automated Eligibility and Benefits Verification

Insurance eligibility errors account for a large percentage of rejections. AI solves this by:

✔ Verifying coverage in real time

✔ Detecting plan limitations

✔ Identifying coordination of benefits issues

Consequently, front-end mistakes no longer disrupt back-end reimbursements.

4. Prior Authorization Intelligence

AI tools analyze procedure data and payer policies to determine when authorization is required.

They can:

- Alert staff before services are rendered

- Track authorization approvals

- Match authorization details with claim submissions

Therefore, providers avoid costly authorization denials and improve first pass claim acceptance rates.

5. Payer Rule Automation

Each insurance company has unique edits and rules. AI continuously learns from payer behavior and historical denials to predict rejection risks.

This means:

🔹 Claims are formatted per payer preference

🔹 Common denial triggers are avoided

🔹 Edits are applied automatically

Over time, the system becomes smarter, leading to consistently higher first-pass performance.

6. Clinical Documentation Intelligence

AI doesn’t just look at codes — it reviews clinical documentation.

Natural Language Processing (NLP) can:

- Identify missing physician notes

- Detect unsupported procedures

- Ensure diagnosis specificity

Thus, claims are backed by strong documentation before submission.

Clean Claims Strategy: The Foundation of First Pass Success

To improve first pass claim acceptance, providers must shift from reactive denial management to a clean claims strategy.

Key Elements of a Clean Claims Strategy

- Pre-bill AI Scrubbing – Detect errors before submission

- Real-Time Edits – Fix issues instantly

- Front-End Accuracy – Verify data at registration

- Coding Intelligence – Ensure compliance and specificity

- Payer Insights – Learn from historical denial trends

Platforms like Aiclaim bring all these elements together into one AI-driven workflow, ensuring claims go out right the first time.

Measurable Results Providers See with AI

Organizations that implement AI in their RCM processes often report:

📈 20%–40% improvement in first pass claim acceptance

📉 30% reduction in denial rates

⏱ Faster payment cycles

💵 Lower cost to collect

🔄 Reduced rework and appeals

Therefore, AI not only improves operational efficiency but also strengthens financial performance.

Why RCM Leaders Are Prioritizing AI Now

Healthcare margins are tightening. Labor shortages make manual claim review unsustainable. Meanwhile, payer complexity continues to grow.

Because of these pressures, RCM leaders are adopting AI to:

- Scale without increasing staff

- Reduce preventable denials

- Improve first pass claim acceptance

- Stabilize revenue

AI is no longer a luxury — it’s becoming a necessity for financial sustainability.

How Aiclaim Helps Improve First Pass Claim Acceptance

Aiclaim delivers AI-powered claims intelligence designed specifically to help healthcare organizations submit cleaner claims and get paid faster.

Aiclaim’s Key Capabilities

✅ Predictive claim scoring before submission

✅ Automated coding and documentation checks

✅ Payer-specific rule validation

✅ Real-time eligibility verification

✅ Authorization tracking and alerts

✅ Continuous learning from denial patterns

By combining automation with predictive analytics, Aiclaim empowers billing teams to focus on resolution instead of rework.

The Future of First Pass Claim Acceptance Is AI-Driven

As reimbursement rules grow more complex, the gap between manual processes and AI-driven automation will continue to widen.

Providers that embrace AI today will:

✔ Submit cleaner claims

✔ Reduce financial risk

✔ Improve first pass claim acceptance

✔ Achieve faster, more predictable revenue

Meanwhile, those relying solely on traditional workflows may struggle with rising denials and delayed payments.

Final Thoughts

Improving first pass claim acceptance is one of the fastest ways to strengthen a healthcare organization’s financial health. While staff training and workflow improvements help, they are no longer enough on their own.

AI brings the intelligence, speed, and accuracy needed to prevent errors before claims ever reach payers. With solutions like Aiclaim, providers can transform their revenue cycle from reactive to proactive — and from unpredictable to optimized.