In today’s highly competitive insurance market, maximizing revenue potential is not just a goal—it is a necessity. Companies that fail to optimize their processes, pricing, and customer engagement risk losing ground to more innovative competitors. Fortunately, advancements in artificial intelligence (AI) have transformed the way insurers approach growth. With the right AI tools, insurers can increase efficiency, reduce losses, and unlock new revenue streams.

At Aiclaim, we empower insurance providers with intelligent solutions that not only streamline claims management but also create opportunities for sustainable growth. Let’s explore how insurers can leverage AI to maximize their revenue potential.

Why Maximizing Revenue Potential Matters

The insurance sector operates on thin margins. Between claim payouts, regulatory compliance, and administrative costs, profit margins can quickly shrink. Therefore, maximizing revenue potential becomes essential to maintain growth and competitiveness.

Moreover, customer expectations are evolving rapidly. Clients demand faster claims processing, personalized policies, and transparent communication. As a result, insurers must find ways to increase revenue while delivering exceptional customer experiences.

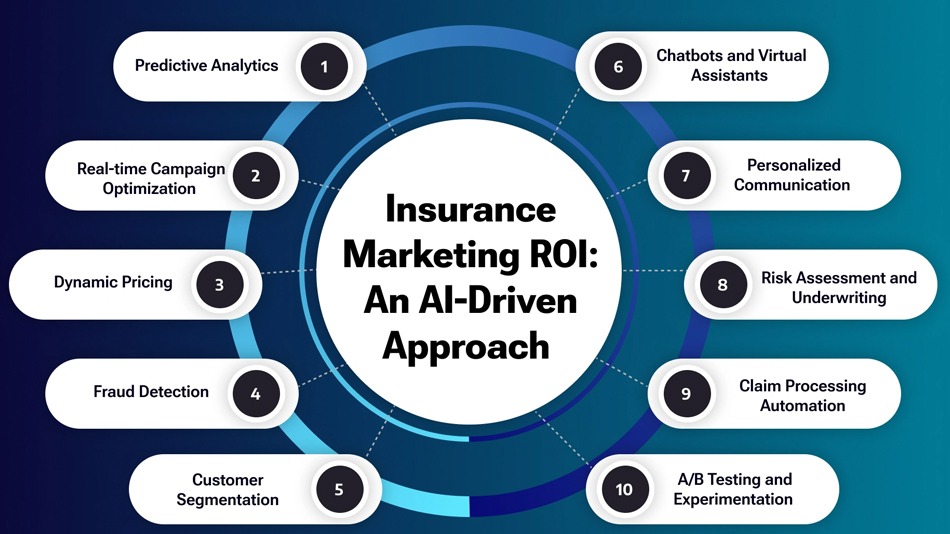

Key Strategies for Maximizing Revenue Potential

1. Optimized Pricing Strategy

One of the most powerful levers for revenue growth lies in pricing optimization. Traditional pricing models often overlook critical risk factors, leading to underpricing or overpricing policies. Both situations harm revenue: underpricing reduces profitability, while overpricing drives customers away.

By implementing AI-powered pricing models, insurers can analyze massive datasets to identify the right price for every customer segment. This ensures fair, competitive pricing while improving profitability.

👉 Learn more about how Aiclaim helps insurers with optimized pricing strategies.

2. Fraud Detection and Risk Mitigation

Insurance fraud costs the industry billions each year, directly impacting revenue potential. However, AI-powered fraud detection systems can identify anomalies in real time, flagging suspicious claims before they escalate into financial losses.

Consequently, insurers not only save money but also gain customer trust by ensuring genuine claims are settled quickly. With smarter fraud detection, companies can maximize revenue potential by minimizing unnecessary payouts.

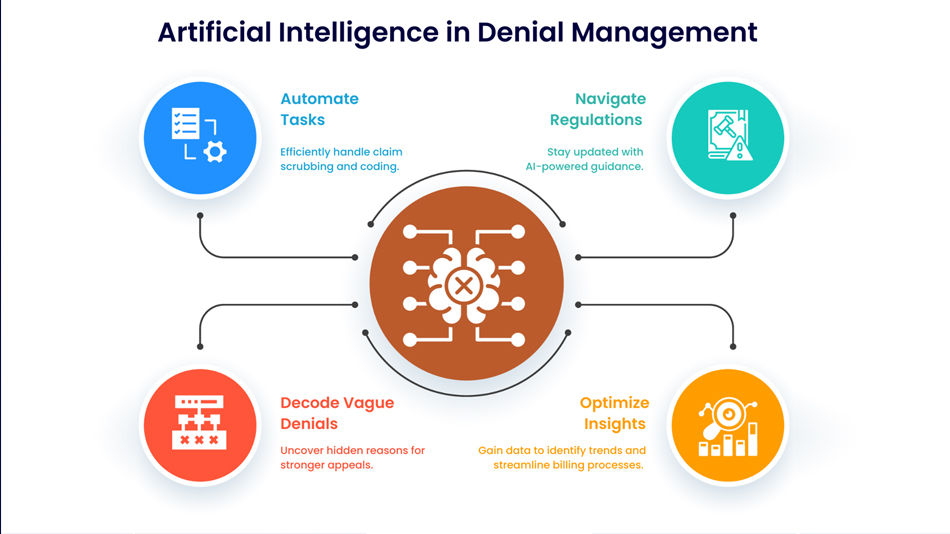

3. Intelligent Claims Processing

A faster claims cycle directly improves customer satisfaction, which, in turn, drives retention and long-term revenue. AI automates document analysis, claim verification, and settlement processes, reducing manual errors and delays.

As a result, insurers save costs while delivering superior customer experiences. This balance between efficiency and satisfaction ensures that revenue potential is fully maximized.

4. Personalized Insurance Offerings

Customers are no longer satisfied with generic policies. They prefer personalized plans that reflect their unique needs. With AI-driven analytics, insurers can segment customers, understand behavioral patterns, and tailor offerings accordingly.

When customers receive products designed for them, they are more likely to purchase, stay loyal, and even recommend the provider to others. Thus, personalization significantly contributes to maximizing revenue potential.

5. Data-Driven Decision Making

Finally, insurers that rely on real-time analytics make smarter, faster, and more accurate business decisions. From underwriting to marketing campaigns, AI provides actionable insights that boost revenue.

By combining predictive analytics with historical data, insurers can anticipate trends, mitigate risks, and stay ahead of the competition. In other words, data-driven strategies are the foundation for sustainable revenue growth.

The Role of Aiclaim in Revenue Maximization

At Aiclaim, we understand the challenges insurance providers face when trying to grow revenue while managing operational complexities. That is why our solutions are designed to integrate seamlessly into existing systems, offering:

- AI-powered claims automation

- Smart fraud detection

- Document intelligence

- Personalized policy recommendations

- Optimized pricing insights

With these tools, insurers can maximize efficiency, reduce risks, and unlock new opportunities for revenue growth.

Conclusion

In conclusion, maximizing revenue potential in insurance requires more than cost-cutting—it demands innovation. By adopting AI-driven solutions, insurers can transform their operations, deliver personalized customer experiences, and ensure long-term profitability.

Whether through optimized pricing strategies, fraud detection, or intelligent claims automation, the path to revenue growth is clear. With the right partner, like Aiclaim, insurers can confidently move toward a future of higher efficiency and greater profitability.