In today’s fast-paced healthcare environment, maintaining a healthy cash flow is more challenging than ever. Increasing patient volumes, complex payer requirements, and frequent claim denials can severely impact revenue. Fortunately, AI-powered billing solutions are transforming how medical practices manage their finances and overcome these issues.

Let’s explore how you can enhance cash flow and ensure consistent revenue by embracing smart, AI-driven billing technology.

1. Automate Claims Processing for Faster Payments

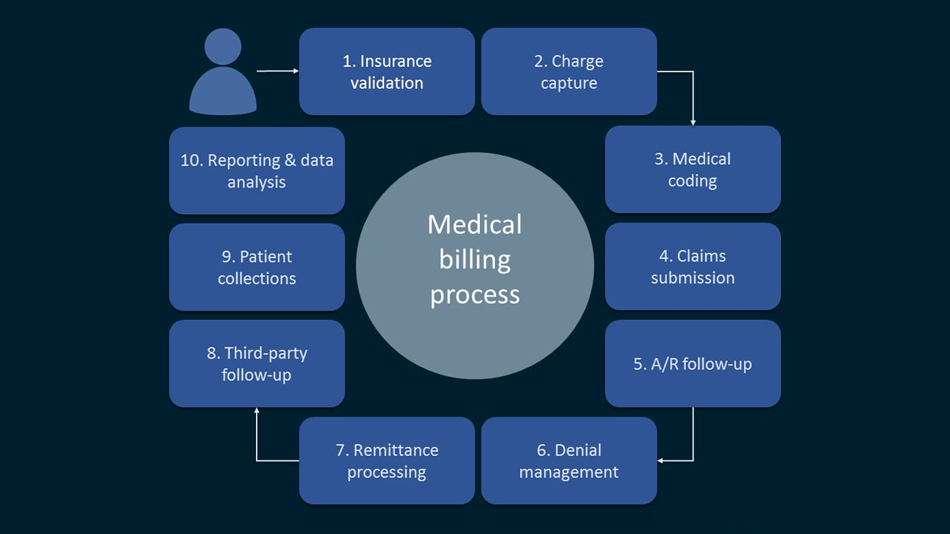

To begin with, AI-powered billing solutions can streamline your entire claims cycle. Instead of relying on manual entry and human review, AI automates claim creation, error checking, and submission. As a result, your practice can significantly reduce turnaround times.

Moreover, faster and more accurate claim submissions lead to quicker reimbursements. This alone can dramatically improve your monthly cash flow.

2. Reduce Claim Denials with Intelligent Error Detection

Another major benefit of AI billing systems is their ability to catch coding and billing errors before a claim is submitted. Traditional systems often overlook small mistakes, which eventually result in denials or delays.

In contrast, AI continuously learns from historical data, enabling it to flag common errors and suggest corrections in real-time. Consequently, practices experience fewer denials, leading to more consistent collections.

3. Shorten AR Days with Predictive Analytics

Furthermore, AI uses predictive analytics to forecast payment patterns and identify which claims are likely to be delayed. With this insight, your billing team can proactively follow up on high-risk accounts, rather than waiting for issues to arise.

By shortening Accounts Receivable (AR) days, your practice can enjoy a smoother, faster revenue cycle.

4. Improve Staff Efficiency and Productivity

In addition, by automating repetitive billing tasks, AI allows your staff to focus on more strategic work, such as patient engagement or financial planning. Not only does this reduce burnout, but it also enhances overall productivity across your organization.

And as your team spends less time fixing billing errors or reworking claims, your revenue recovery process becomes more efficient.

5. Gain Real-Time Financial Insights and Reporting

AI-powered billing solutions also provide real-time dashboards and detailed reports. These insights help you understand revenue trends, track KPIs, and identify areas for improvement.

Therefore, by making informed decisions based on accurate data, you can fine-tune your billing strategy to maximize cash flow and minimize financial risks.

Conclusion: The Future of Medical Billing Is AI-Powered

In summary, if your medical practice is facing slow collections or cash flow issues, it’s time to rethink your billing process. By adopting AI-powered billing solutions, you can reduce denials, accelerate reimbursements, and gain full visibility into your financial performance.

Don’t let outdated billing practices hold your practice back. Instead, embrace AI technology and unlock a healthier, more sustainable revenue stream.