In the ever-evolving landscape of insurance and finance, real-time risk assessment is rapidly becoming the new standard. Traditionally, risk evaluation involved time-consuming manual analysis, historical data reviews, and, as a result, often delayed decision-making. However, with the integration of artificial intelligence (AI), underwriting has taken a transformative leap forward. Now, instead of relying solely on outdated methods, insurers can leverage AI to assess risk dynamically and efficiently. Consequently, this shift not only streamlines underwriting processes but also enhances accuracy and boosts overall profitability. In this blog, we’ll explore how AI is revolutionizing underwriting and setting a new benchmark for the industry.

What is Real-Time Risk Assessment?

At its core, It refers to the process of evaluating potential risks instantaneously as new data becomes available. Unlike traditional methods, which rely on static data, AI-powered risk models continuously analyze dynamic inputs—such as behavioral data, geolocation, and real-time financial indicators—to assess risk profiles in milliseconds.

By using machine learning and predictive analytics, insurers can now make faster and more informed underwriting decisions, reducing uncertainty and improving operational efficiency.

Why Real-Time Risk Assessment Matters in Underwriting

1. Faster Decision-Making

One of the primary advantages is speed. AI algorithms analyze multiple variables instantly, allowing underwriters to approve or flag applications within seconds. This significantly reduces turnaround times, improving customer experience and satisfaction.

2. Enhanced Accuracy with AI Models

Traditional risk models are static and often outdated. In contrast, AI-powered tools continuously learn and adapt, ensuring higher accuracy in evaluating risk. This minimizes false positives and helps underwriters avoid costly errors.

3. Dynamic Data Integration

With access to real-time data—such as IoT inputs, social media trends, transaction logs, and more—insurers can form a more comprehensive risk profile. This kind of real-time risk assessment leads to better personalization and more competitive pricing models.

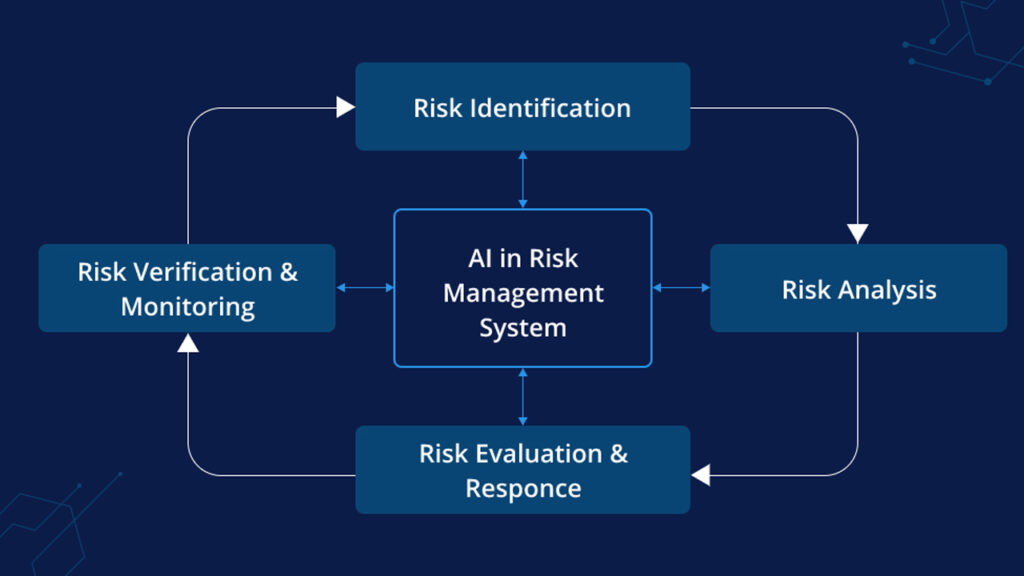

How AI Powers Real-Time Risk Assessment

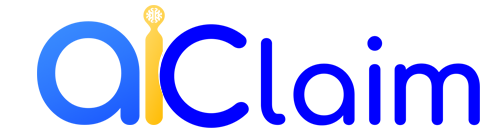

AI systems use a combination of:

- Machine Learning: To identify risk patterns and predict future behaviors.

- Natural Language Processing (NLP): To analyze textual data, such as claims notes or customer feedback.

- Big Data Analytics: To process massive datasets across various channels in real-time.

These technologies work together to deliver insights that enhance underwriting precision while maintaining compliance and data security.

Use Cases of Real-Time Risk Assessment in Insurance

- Health Insurance: Assessing individual health metrics in real time via wearables.

- Auto Insurance: Leveraging telematics data for real-time driver behavior analysis.

- Property Insurance: Using satellite and environmental data for instant damage evaluation.

These examples illustrate the growing importance of real-time risk assessment across multiple insurance verticals.

Benefits for Insurers and Customers

- Reduced Claims Costs: By identifying high-risk customers early, insurers can set appropriate premiums or deny high-liability applications.

- Better Customer Experience: Instant approvals and personalized plans lead to higher retention.

- Fraud Prevention: Real-time AI models detect anomalies that may indicate fraudulent behavior.

The Future of Underwriting is Real-Time

The shift toward real-time risk assessment is more than a trend—it’s a necessary evolution. As customer expectations rise and data becomes more accessible, insurance companies must adopt AI-driven tools to stay competitive.

By integrating into underwriting workflows, insurers not only improve efficiency but also enhance decision-making and risk management across the board.

Final Thoughts

It is no longer a luxury; it’s a competitive advantage. As AI technologies continue to evolve, their role in underwriting will only grow stronger. By embracing AI-powered real-time risk assessment, insurers can position themselves at the forefront of innovation, delivering faster, smarter, and more reliable coverage to their customers.